In 2026, the banking and financial sector remains the #1 target for sophisticated cyber-extortion. The industry has moved beyond basic defense into a “hyper-regulatory” era, where resilience is measured not just by stopping attacks, but by how quickly a bank can recover without disrupting the global financial “plumbing.”

1. High-Priority Threats (2026)

- Deepfake-Enabled Fraud: Attackers now use real-time AI voice and video cloning to bypass “voice biometrics” and trick bank employees into authorizing high-value wire transfers.1 This has evolved into BEC 2.0 (Business Email Compromise).

- Synthetic Identity Theft: Criminals use AI to create “Frankenstein” identities—combining real stolen social security numbers with fake names and addresses.2 These accounts often lay dormant for months to build credit before “busting out” with massive fraudulent loans.

- API & Open Banking Vulnerabilities: As banks share more data with Fintech partners via APIs (driven by regulations like the CFPB Section 1033 in the US), these connections have become the primary “backdoor” for data theft.3

- “Harvest Now, Decrypt Later” (HNDL): State-sponsored actors are currently stealing encrypted financial data with the intent of decrypting it once Quantum Computing becomes powerful enough to break current RSA/ECC standards.4

2. Regulatory Landscape: DORA and Beyond

2026 marks a turning point in compliance, shifting from “paper-based” checklists to Operational Resilience.

| Regulation | Scope / Requirement | 2026 Impact |

| DORA (EU) | Digital Operational Resilience Act | Banks must prove they can withstand a total IT shutdown and resume operations within hours. |

| SEC Disclosures | Mandatory Incident Reporting | Publicly traded financial firms must disclose “material” breaches within 4 days, forcing extreme transparency. |

| GLBA / NYDFS | Data Safeguards | Updated rules now require Continuous Asset Inventory and mandatory MFA for all privileged access. |

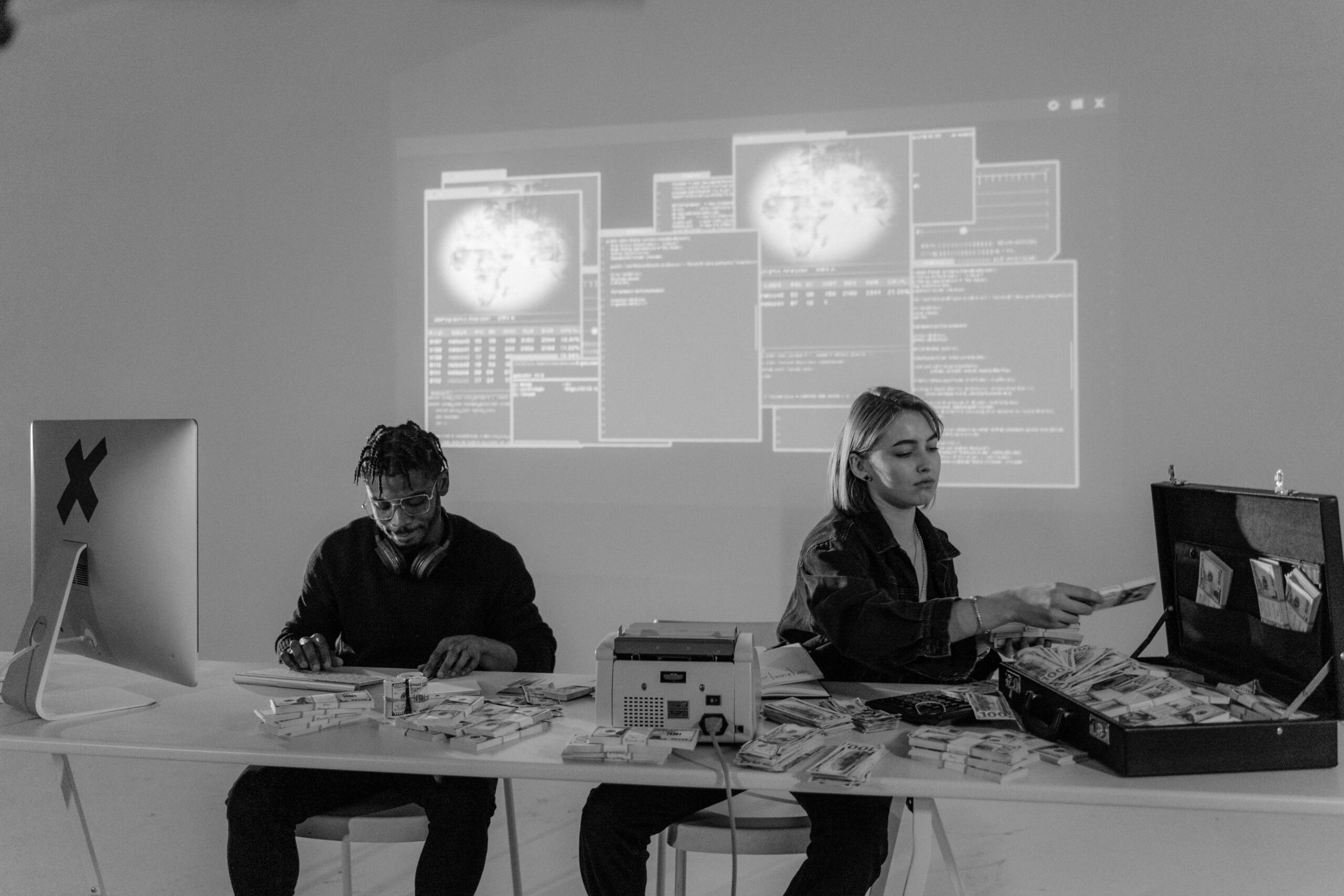

| FRAML | Fraud + Anti-Money Laundering | Regulators now expect banks to merge their Fraud and AML teams into a single AI-driven unit to spot complex money laundering loops. |

3. The Defensive Frontier: AI vs. AI

To combat automated attacks, financial institutions are deploying “Defense AI”:5

- Behavioral Biometrics: Instead of just checking passwords, banks monitor “how” a user interacts—measuring typing speed, mouse movements, and even the angle at which a phone is held—to detect bot-driven account takeovers.6

- Graph Analytics: AI now maps the hidden connections between millions of transactions to identify “money mule” networks that traditional rule-based systems miss.7

- Post-Quantum Cryptography (PQC): Leading banks have begun transitioning their “long-lived” data (like mortgages and life insurance) to NIST-standard quantum-resistant algorithms to defeat future decryption threats.

4. Third-Party Risk (The Vendor Trap)8

In 2026, 60% of banking breaches originate from a third-party vendor (cloud providers, payment processors, or even HVAC systems).

- The “Concentration Risk”: Regulators are now penalizing banks that rely too heavily on a single cloud provider (e.g., AWS or Azure) without a “multi-cloud” exit strategy.

- Supply Chain Audits: Banks now use automated tools to continuously “score” the security posture of every fintech partner in real-time.

Leave a Reply